There’s a Coverage Gap With That App

By: Gary Jennings (Property Casualty 360) April 2016

Sharing services such as Uber, Lyft and Airbnb have been in the news quite a bit lately.

There was the horrific story about the Uber driver in Kalamazoo who allegedly killed six people and injured two others between picking up and dropping off some of his passengers. And then there was the recent article about some Airbnb patrons who found a decomposing woman’s body in the garden of the Palaiseau, France, home in which they were staying. These are terrible stories but are incidents that could also happen while using other forms of transportation, staying in hotels, or going about everyday life.

There are some issues, however, which apply specifically to these service-sharing applications (apps) and their use, creating risks and financial exposures for the service supplier and customer if the providers are not properly insured to deliver these services.

Automobile exposures

Anyone who plans to make additional money as an Uber, Lyft or other ride-sharing service driver should be aware of the insurance gaps that may exist. Failure to consider them may expose the driver to unexpected consequences. One of the ride-sharing platforms states on its opening website page — “Signing up is easy — Sign up today and you’ll be on the road in no time. Plus, signing on takes less than 4 minutes. Don’t wait to start making great money with your car.”

The risk to a new driver is immediate because the usual automobile liability coverage is specifically excluded when working with these ride-sharing platforms. For example, a Georgia automobile policy states the following exclusions under the Liability Coverage, Medical Expense Coverage and Uninsured Motorist Coverage sections:

Exclusions

1. This coverage does not apply to bodily injury or property damage to a person:

a. While occupying your insured car when used to carry persons or property for a charge. This exclusion does not apply to shared-expense car pools or the charitable carrying of persons.

Therefore, a potential driver should not plan to work immediately after signing up for the service. Drivers should purchase commercial automobile liability to cover the losses excluded by their personal automobile policies. Some insurance companies have attempted to provide commercial policies for these drivers, but it is fair to say that the market is still trying to understand the real exposures they face. Potential drivers should research the insurance requirements for their state and discuss this with an insurance agent to obtain the necessary coverage at a reasonable price, since there seem to be wide variations in pricing for this product. Be sure that the cost of this commercial policy does not negate the financial benefit of driving.

Potential drivers should also clearly understand the rules, exclusions and coverage limitations imposed by these ride-sharing platforms. While each of these companies provides some guidance or information on insurance requirements, some of them are somewhat unclear, and there have been cases in which the ride-sharing companies were reluctant or slow in assuming liability for their portions of the loss.

The insurance requirements these companies list also vary by state or even city, and some of the coverage they provide is contingent on the driver’s coverage. Each state has its own rules concerning the minimum limits for liability coverage, and some in the industry definitely believe that minimum limits are rarely sufficient.

This is especially true for those who live in an area with relatively well-to-do customers or in an especially litigious area. Potential drivers who plan to serve an area encompassing two or more states should also research the rules and requirements for each state in which they may drive.

For example, a driver in certain parts of New Hampshire should consider requirements in New Hampshire, Vermont, Maine, and Massachusetts. A driver in Washington, D.C., should consider requirements in D.C., Virginia, Maryland, West Virginia, Delaware, and even parts of Pennsylvania. You get the picture.

Homeowners’ exposures

Airbnb is perhaps the best-known “home-sharing” app, but many individuals with second homes, especially in typical “vacation” areas, may also exchange or lease their properties. Property providers should consider potential exposures to confirm they have appropriate coverage for the risks.

Airbnb provides “Host Protection Insurance,” which is primary liability coverage for Airbnb hosts and landlords up to $1,000,000 through Lloyd’s of London. While this is substantial coverage, each host or landlord should determine if $1,000,000 is sufficient. The risks around the property as well as the financial condition of the guests should be considered.

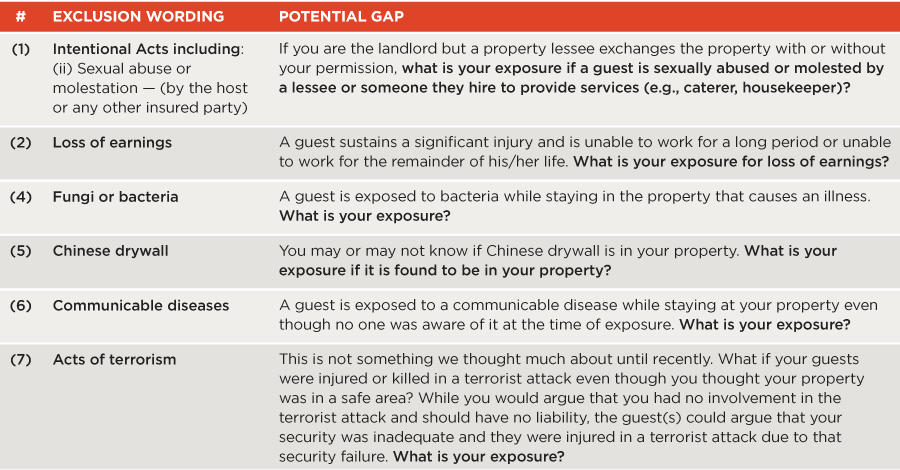

The coverage also excludes some items that may represent a substantial gap in protection. For example, the coverage description states that the “program does not apply to liability arising from (1) intentional acts including: (i) Assault and battery or (ii) Sexual abuse or molestation — (by the host or any other insured party), (2) Loss of earnings, (3) Personal and advertising injury, (4) Fungi or bacteria, (5) Chinese drywall, (6) Communicable diseases, (7) Acts of terrorism, (8) Product liability, (9) Pollution, and (10) Asbestos, lead or silica.”

Let’s take a few of these exclusions to examine the potential exposures (see table below).

Owners should also be aware that their own Homeowners coverage may not apply if they are exchanging or leasing their property. Even if it did, there are many exclusions that may also prevent them from having the coverage they need. Homeowners insurance and Commercial Property insurance are constantly evolving, with new exclusions and conditions appearing annually.

There are a number of potential risks in providing these services, too many to be covered in-depth here. Some of these “service-sharing” apps are opportunities to provide owners or drivers with additional income or ways to swap with others to allow travel to areas that may otherwise be unaffordable. However, it is wise to be cautious and ensure that this extra income or property-swapping event does not turn into an incident from which you can never recover.

Categories

- Benefits Resources

- Bonding

- BOP

- Business Insurance

- Commercial Auto

- Commercial Property

- Company News

- Construction

- Crime Insurance

- Cyber Insurance

- Directors & Officers

- Employee Benefits

- Employment Practice Liability Insurance

- Entertainment

- General Liability

- Health Insurance

- Healthcare

- Healthcare Reform

- Homeowners Insurance

- Hospitality

- Manufacturing

- Medical Malpractice

- Mining & Energy

- Nightclubs

- Personal Auto

- Personal Insurance

- Professional

- Restaurants

- Retail & Wholesale

- Risk Management Resources

- Safety Topics

- SBA Bonds

- Security

- Seminars

- Technology

- Tourism

- Transportation

- Uncategorized

- Workers Compensation

Archives

- May 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- November 2018

- September 2018

- August 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- February 2013

- November 2011

- October 2011

- September 2011

- July 2011

- June 2011

- March 2011

- November 2010

- October 2010

- September 2010

- April 2010

- February 2010

- November 2009

- October 2009

- November 2008

- August 2008