Auto Insurance Affordability Improves in Most States: IRC

Insurance Research Council (IRC), Insurance Journal, August 2015

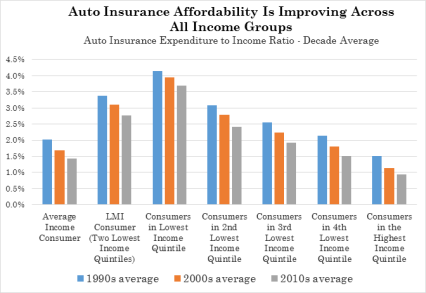

Personal auto insurance has become more affordable over time for all income groups, including low-to-moderate income groups, and in most states, according to a report from the Insurance Research Council (IRC).

The industry group says the study also shows that the degree of improvement in auto insurance affordability is not being witnessed in other industries.

The study includes state estimates indicating that auto insurance affordability has also been improving in most states. All but five experienced improved affordability from the 1990s to the 2000s, and all but four have shown an improvement in affordability between the 2000s and the present.

Affordability does vary across states, however. According to the report, auto insurance was least affordable in Louisiana (2.85 percent of income), Florida (2.45 percent), New York (2.42 percent), Delaware (2.18 percent) and Michigan (2.10 percent).

The most affordable states were found to be North Dakota (1.03 percent of income), Iowa (1.05 percent), New Hampshire (1.06 percent), Virginia (1.07 percent) and Wyoming (1.08 percent).

The study, “Trends in Auto Insurance Affordability,” used an auto insurance expenditure-to-income ratio to analyze auto insurance affordability. The report does not prescribe a specific threshold at which auto insurance may be considered affordable. Instead, it examines trends in affordability, which IRC says reduces the subjectivity involved in affordability analysis.

The report compares affordability trends for auto insurance to the affordability trends for other industries whose products or services are considered necessities. Auto insurance was found to represent a smaller percentage of the average consumer’s budget and lower-to-moderate income consumer’s budget. It also has had unprecedented affordability improvements over time.

The auto insurance expenditure-to-income ratio was calculated using insurance expenditure data from the National Association of Insurance Commissioners and the Bureau of Labor Statistics Consumer Expenditure Survey. IRC said both methods revealed dramatic improvements in national auto insurance affordability over the long-term for average and low-to-moderate income consumers. Currently, about 1.5 percent to 1.6 percent of income is spent on auto insurance in the U.S. by the average consumer, which represents much lower figures than seen in previous decades, according to IRC. Low-to-moderate income consumers have also witnessed similar trends, the researchers said.

“There is a lot of interest in the affordability of auto insurance on the part of consumers, policymakers and regulators. This report adds to the discussion, showing that auto insurance is becoming more and more affordable,” said Elizabeth Sprinkel, senior vice president of the IRC.

Categories

- Benefits Resources

- Bonding

- BOP

- Business Insurance

- Commercial Auto

- Commercial Property

- Company News

- Construction

- Crime Insurance

- Cyber Insurance

- Directors & Officers

- Employee Benefits

- Employment Practice Liability Insurance

- Entertainment

- General Liability

- Health Insurance

- Healthcare

- Healthcare Reform

- Homeowners Insurance

- Hospitality

- Manufacturing

- Medical Malpractice

- Mining & Energy

- Nightclubs

- Personal Auto

- Personal Insurance

- Professional

- Restaurants

- Retail & Wholesale

- Risk Management Resources

- Safety Topics

- SBA Bonds

- Security

- Seminars

- Technology

- Tourism

- Transportation

- Uncategorized

- Workers Compensation

Archives

- May 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- November 2018

- September 2018

- August 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- February 2013

- November 2011

- October 2011

- September 2011

- July 2011

- June 2011

- March 2011

- November 2010

- October 2010

- September 2010

- April 2010

- February 2010

- November 2009

- October 2009

- November 2008

- August 2008