Emerging Risks and How Consumers and Businesses are Mitigating Them

By: Danielle Ling, Property Casualty 360, November 2017

The 2017 Travelers Risk Index surveys found that consumers and businesses perceive global conflict, cyber and the changing workforce as the greatest threats. The 2017 Travelers Risk Index surveys found that consumers and businesses perceive global conflict, cyber and the changing workforce as the greatest threats.

The yearly report identifies the overall perception of risks for consumers and business leaders and what worries them most. The study also identifies emerging trends among consumers and businesses separately, and whether each view these trends as great opportunities, great risks or both.

The 2017 Travelers Risk Index was compiled by Hart Research, which issued two national online studies this past spring. One surveyed 1,203 business decision-makers, and the second surveyed 1,016 consumers ages 18 to 69 about each group’s overall perception of risks, emerging trends, and their related risk-mitigating behaviors.

Emerging trends and risks among consumers

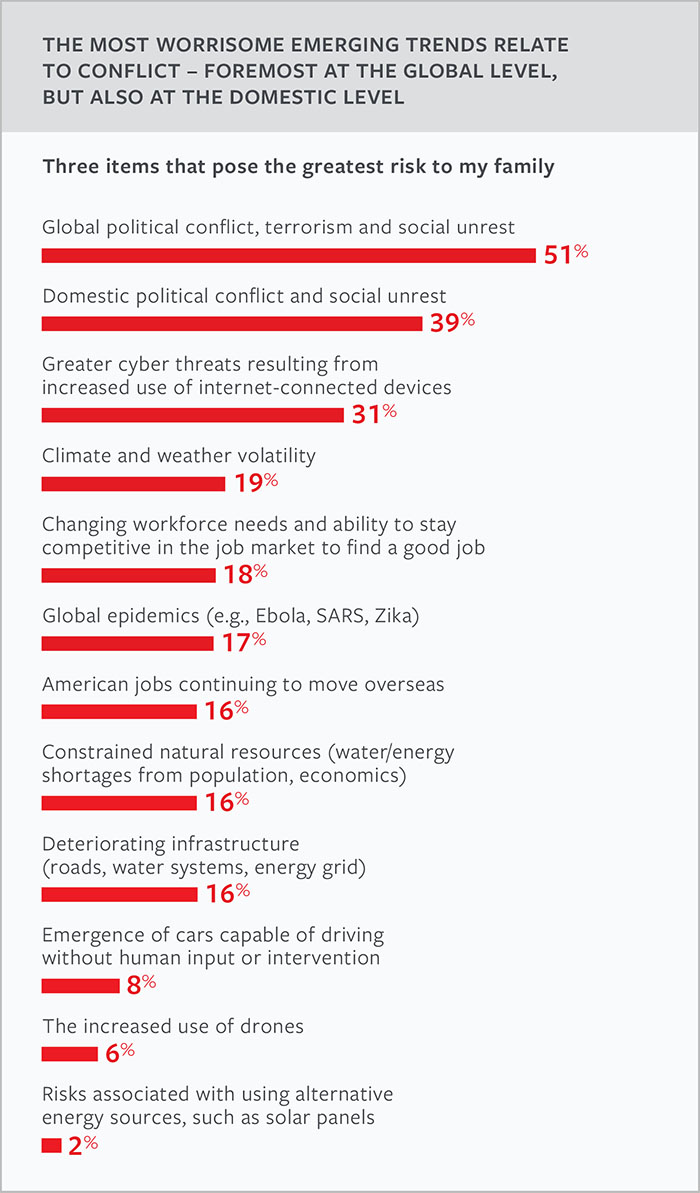

Consumers surveyed in the Travelers Risk Index identified which of the 12 emerging trends posed the greatest risk to themselves and their families. The responses show the most worrisome risks are ones that relate to conflict, cyber, the environment and the changing workforce.

With the greatest response, 51% perceive global political conflict, terrorism and social unrest as the greatest risk posed to the consumers surveyed and their family members. Following this risk is domestic political conflict and social unrest, listed by 39% of respondents, and the rise in cyber threats from the increased use of internet-connected devices (31%).

The survey results showed that consumers also worry about threats relating to the natural world, including climate and weather volatility, global epidemics and constrained natural resources.

The changing workforce is another concern, according to the Risk Index report. Consumers are concerned about their market value and whether they have the new skills needed for today’s businesses. Other related worries consumers cited included their ability to stay competitive in the job market, and concerns about U.S. jobs continuing to move overseas.

Emerging trends and risks among businesses

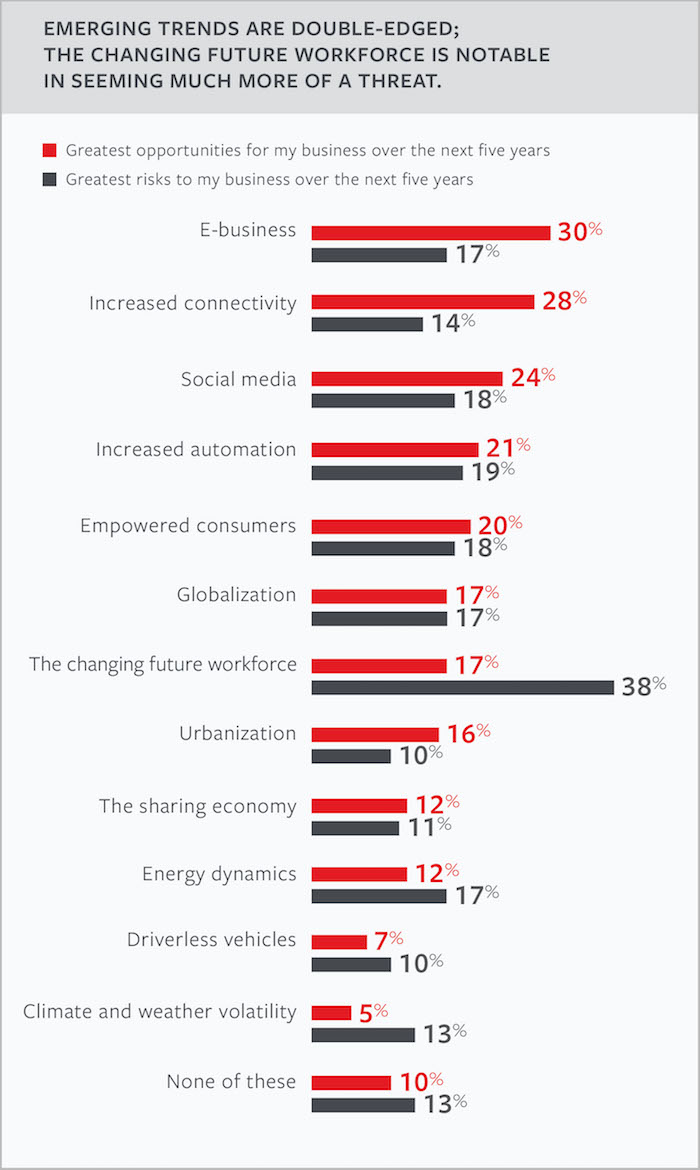

The changing future workforce is a major concern for businesses as well. With 38% of the response, the changing future workforce – aging workers, the influx of millennials and the changing worker skill availability – was the greatest risk cited in the Business Risk Index survey conducted by Travelers and Hart Research Associates.

This particular survey in the Travelers Risk Index (see right) identified 12 emerging business trends and business owners’ perceptions of each as either great opportunities, great risks, or both. The survey also analyzed the strategies and tools business owners use to mitigate risk.

The emerging trends that rank highest in terms of opportunity all revolve around emerging technologies that connect people with products and information.

According to the survey report, the biggest opportunities identified by small and midsized businesses include e-business (the increasing use of digital platforms, including mobile, to conduct commerce or make online purchases) increased connectivity and social media.

Among large businesses, increased automation (including “smart” technologies, robotics and artificial intelligence) ranks first. This is followed by e-business and increased connectivity.

Businesses overall are split when it comes to globalization: 17% say it’s an opportunity and the same percentage (17%) perceive it as a threat.

How businesses are (or are not) mitigating these risks

The survey also inquired about the ways businesses are mitigating these risks. Researchers found that despite their many concerns, a majority of business owners don’t feel adequately protected.

When asked if they are confident that their businesses are properly insured against all the potential risks they face, only 3 in 10 business owners/executives (30%) said they feel very confident that they are properly insured, and 3 in 5 feel somewhat confident (57%).

This number is slightly better among large businesses, however, as 34% reported feeling very confident — up 27% from last year. The survey also found that 1 in 4 businesses indicate that preventing, preparing for and responding to risk is a strategic priority, with larger businesses more likely to consider it.

Overall, the report found that 40% of all businesses treat this as an important management activity. Businesses are likely to put into place basic preventative measures that guard against physical harm to employees and premises, such as having emergency exit plans and employee safety training. They are less likely to take measures that represent longer-term investments against less immediate threats, including means for averting cyber risks.

Only 1 in 3 businesses review their data security plans and practices (33%); fewer than 1 in 4 have created a cyber/data breach incident response plan (22%); and fewer than 1 in 4 have established employee data protection education and practices (22%). In addition, only 37% have a periodic review of their insurance needs with their agent or broker, and a little more than half (52%) have a business continuity plan in place.

Categories

- Benefits Resources

- Bonding

- BOP

- Business Insurance

- Commercial Auto

- Commercial Property

- Company News

- Construction

- Crime Insurance

- Cyber Insurance

- Directors & Officers

- Employee Benefits

- Employment Practice Liability Insurance

- Entertainment

- General Liability

- Health Insurance

- Healthcare

- Healthcare Reform

- Homeowners Insurance

- Hospitality

- Manufacturing

- Medical Malpractice

- Mining & Energy

- Nightclubs

- Personal Auto

- Personal Insurance

- Professional

- Restaurants

- Retail & Wholesale

- Risk Management Resources

- Safety Topics

- SBA Bonds

- Security

- Seminars

- Technology

- Tourism

- Transportation

- Uncategorized

- Workers Compensation

Archives

- May 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- November 2018

- September 2018

- August 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- February 2013

- November 2011

- October 2011

- September 2011

- July 2011

- June 2011

- March 2011

- November 2010

- October 2010

- September 2010

- April 2010

- February 2010

- November 2009

- October 2009

- November 2008

- August 2008